Cut property taxes. Increase sin and tourist taxes. Slash community grants and improvement projects — except of, course, for things they shouldn’t.

Those are generally some trends, though far from consensus ones, resulting from Juneau’s first-ever online do-it-yourself budgeting tool allowing anyone to submit a balanced city budget for next year matching the user’s revenue and spending adjustments. Not surprisingly, there are also numerous conflicting and sometimes outlandish suggestions such as hiking certain taxes by stratospheric amounts so other taxes could be cut.

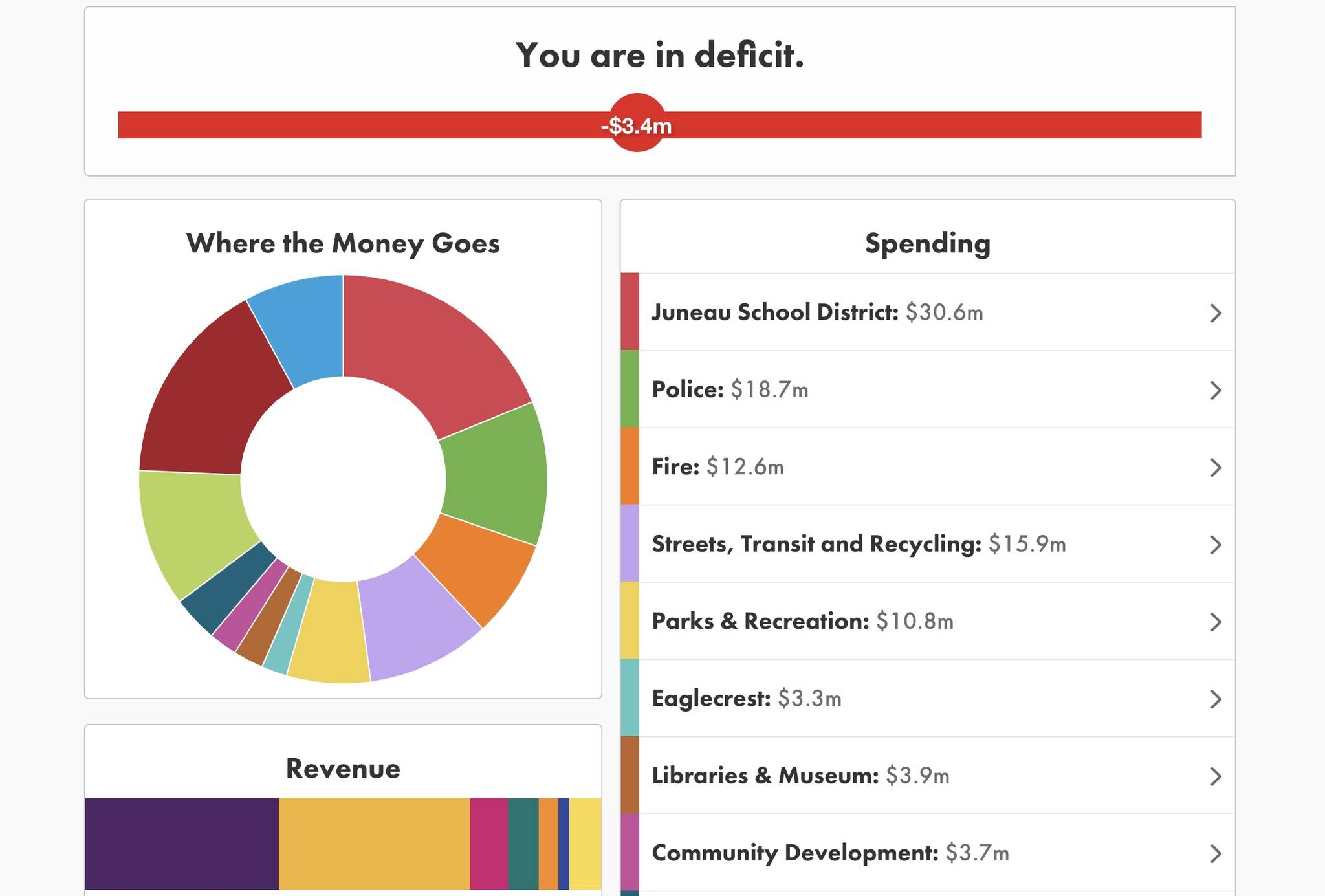

The simulator requires users to fix a $3.4 million deficit by adjusting plus/minus icons in each of the city’s revenue/spending areas, with pop-up windows providing descriptions for each item available. In addition to submitting results to the city, they can be shared with other users who can make their own adjustments.

A total of 73 people submitted spending plans, which Juneau Finance Manager Jeff Rogers shared with Assembly members during their Finance Committee meeting on Wednesday. He noted some obviously weren’t realistic, but the simulator serves a useful purpose by helping the public understand decisions policymakers confront during the budget process.

“I think the primary purpose of that tool is education,” he said.

That said, presentation of simulated budgets didn’t fall on deaf ears. Results were subsequently mentioned a few times by Assembly members during the meeting — and may have been in some minds when the committee voted 5-2 to reject a 0.1 increase in the current 10.56 property tax mill rate, equating to a $50 a year savings for a person who owns a $500,000 home.

The top suggestion for increasing revenue was boosting sales, alcohol, tobacco and marijuana taxes by an average of about $1.4 million, while the top revenue-reduction measure was reducing property taxes by $1.1 million. Rogers said that’s not surprising.

“It fits the theme of ‘it would be nice if somebody else paid taxes other than me,’” he said.

The ideas when it came to reducing spending were reducing community grants by an average of $760,235, capital improvements and engineering by $615,924; and streets/transit/recycling by $520,225. The top additional spending suggestions were “new spending ideas” at $260,285 (a $60,000 center for “pickleball and other activities,” for example), capital improvements and engineering at $236,602 and streets/transit/recycling at $164,228.

Among the specific suggestions (some edited slightly for grammar/clarity):

“Cut each proposed budget 2.1%, 3.4M deficit achieved. If your directors cannot achieve this cut in their capital expenditures or operations, you have the wrong people in charge of the respective departments. Tie their incentive to the 2.1% reductions, and get employees to come up with innovative ideas to reduce expenses. Every CBJ employee knows where their department can save a little money.”

Generate $1 million with “non-local retail business tax for high tourist areas. This will both add income and promote growth of local business owners. After all, tourists come here for the culture and nature. Not bamboo sheets and bogus jewelry shops.”

Spending $2 million for affordable housing. “You could build tiny apartments, which would house a lot of low income people. The city could own this property and the money earned can go straight into the city budget.”

“Use surplus reserve funds to reduce property taxes 10% on a 1:1 basis for the next three years. Do not build city Taj Mahal – move city hall to JDHS and consolidate high school at TMHS.”

The online simulator did put some restrictions on how much users could increase or decrease some categories, due to such factors as legally required mandates. But it was still possible to set the property tax mill rate at zero and increase the hotel bed tax by about 600% to make up the difference, which Rogers said might need fine-tuning.

“It’s kind of a learning process for us on how to make the tool work well,” he said. “There might need to be limits on what we let people stick in there.”

Assembly members expressed interest in the results and the simulator’s potential for engaging the public in the future.

“I think this is interesting information and I hope we keep doing it,” Assembly member Carole Triem said.

• Contact reporter Mark Sabbatini at Mark.Sabbatini@juneauempire.com.